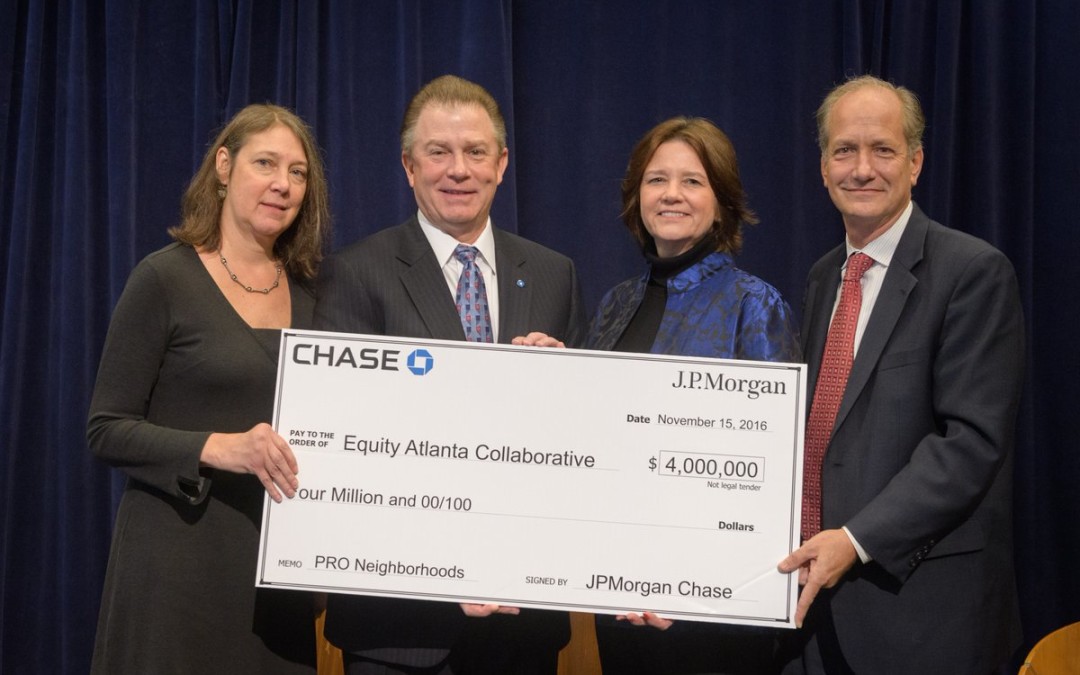

Left to Right: Nancy Wagner-Hislip, Reinvestment Fund; David Balos, JPMorgan Chase; Grace Fricks, Access to Capital for Entrepreneurs (ACE); and John O’Callaghan, Atlanta Neighborhood Development Partnership.

Three CDFIs Form Equity Atlanta Collaborative to Expand Lending to Housing, Small Businesses and Help Accelerate Economic Recovery

ATLANTA – November 15, 2016 – Access to Capital for Entrepreneurs Inc. (ACE) was named one of three recipients of today’s JPMorgan Chase & Co. $4 million grant announcement. Awarded to Equity Atlanta Collaborative — a new group that brings together ACE, Atlanta Neighborhood Development Partnership (ANDP), and Reinvestment Fund — the nonprofits will work together to provide targeted loan capital and consulting services for high-quality affordable housing projects and small businesses in underserved communities in south Atlanta and Gwinnett County.

As part of JPMorgan Chase’s PRO Neighborhoods initiative, the new Equity Atlanta Collaborative partnership was selected and is one of five projects nationwide led by Community Development Financial Institutions (CDFIs) to accelerate economic recovery. The five CDFI collaboratives selected for the grant are located in Atlanta, Chicago, Detroit, Miami and New York. A total of $20 million will be granted this year as part of JPMorgan Chase’s $125 million, five-year PRO Neighborhoods commitment.

“We are extremely appreciative of JPMorgan Chase for this grant which will allow us to continue our work with providing capital, coaching and connections to small business owners in communities that are in great need,” said Grace Fricks, president and CEO of ACE. “We also look forward to working alongside our ANDP and Reinvestment Fund friends to make a positive impact.”

These collaboratives bring CDFIs together to pool resources and expand lending activities for important projects such as building affordable housing, education facilities, opening retail centers, and supporting main street businesses in key neighborhoods. The Equity Atlanta Collaborative will focus on creating or preserving over 700 affordable housing units and establishing over 1,000 jobs through small business and housing development.

“CDFIs are essential change agents to helping revitalize neighborhoods and create new economic opportunities for individuals and families, and this investment will help build more paths to prosperity in our community,” said David Balos, market leader for JPMorgan Chase in Atlanta and head of the commercial bank.

“I want to thank JPMorgan Chase and the Equity Atlanta Collaborative for their investment in our most

vulnerable neighborhoods,” said Mayor Kasim Reed. “By providing seed capital for rebuilding, they allow residents in communities that have been left behind to access affordable housing and other essential services close to home. This key partnership between a legacy business and a local nonprofit group will leverage homegrown expertise to give residents an opportunity to thrive and join the prosperity of our growing city.”

The Equity Atlanta Collaborative partners have demonstrated success in addressing the issue of economic inequality in Atlanta. ACE is the only small business CDFI loan fund in metro Atlanta, and ANDP is the only local (non-national) housing CDFI. With support from one of the nation’s largest CDFIs, Reinvestment Fund, these organizations will collaborate to devise comprehensive local solutions for some of metro Atlanta’s most vulnerable neighborhoods.

Together, Equity Atlanta Collaborative partners have committed to leveraging the $4 million grant from JPMorgan Chase to continue to increase new lending capital for housing and small business loans. The collaborative partners will also increase outreach to residents to expand access to capital through targeted educational programs and technical assistance. To learn more about these organizations, visit ACE (www.aceloans.org), ANDP (www.andpi.org), or Reinvestment Fund (www.reinvestment.com).

About JPMorgan Chase & Co.

JPMorgan Chase & Co. (NYSE: JPM) is a leading global financial services firm with assets of $2.5 trillion and operations worldwide. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management. A component of the Dow Jones Industrial Average, JPMorgan Chase & Co. serves millions of consumers in the United States and many of the world’s most prominent corporate, institutional and government clients under its J.P. Morgan and Chase brands. Information about JPMorgan Chase & Co. is available at

About ACE

ACE is a 501(c)(3) nonprofit and Community Development Financial Institution (CDFI) loan fund that provides loans and business consulting services to help borrowers throughout metro Atlanta and North Georgia create and grow stable, sustainable businesses that generate jobs. ACE specializes in working with underserved populations, particularly women, minorities and low-income business owners, to help drive economic mobility and build stronger communities. Founded in 1999, ACE has loaned more than $37 million to entrepreneurs, which has created or saved more than 6,600 jobs in Georgia. As a nonprofit, ACE relies on operating and program grants and private contributions to support a portion of its budget. ACE has offices in downtown Atlanta and Cleveland, Ga., and an ACE Women’s Business Center in Norcross, GA. Learn more online at: www.aceloans.org.